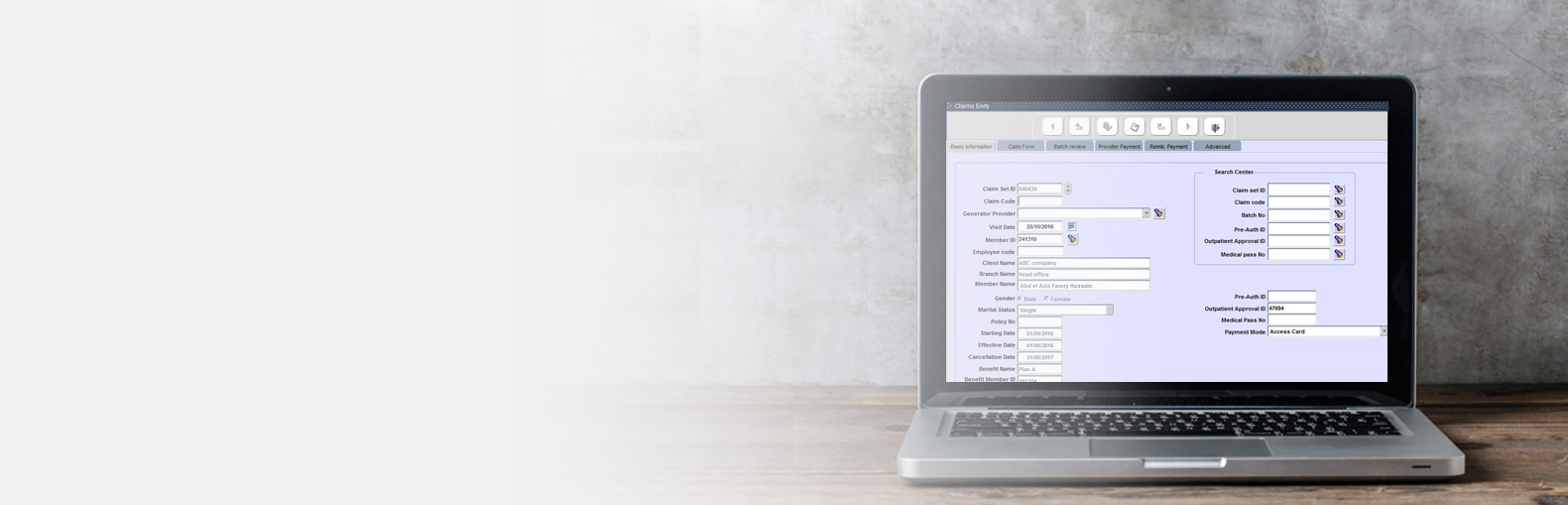

Leading healthcare insurance professionals use Ibn Sina to quickly build and continuously improve their policy building and claims processing function that drive business innovation.

Create your own custom medical insurance policy that is unique to your business model, considers the end-to-end process, meets the needs of today, and can be easily adjusted to meet the continuously changing needs of the business in the future.

Our platform is uniquely designed to support rapid, iterative development by a broad range of users while ensuring that IT retains control. Bring business and IT together to rapidly deliver applications that:

Increase premium volumes

Improve customer & broker loyalty

Drive operational efficiency

Identify and eliminate billing errors.

Enhance profitability